Mexican GP

As a result of the covid pandemic restrictions the automotive sector was particularly hard hit. The Mclaren Group was not immune to this and despite laying off 1200 employees, which included 70 from the racing division, the group was in dire need of further funding.

In June 2020, McLaren announced its intention to raise £275 million by leveraging its renowned Woking headquarters and heritage collection as collateral. This initiative prompted legal proceedings, as creditors sought to prevent the transaction, contending that these assets had previously been used to secure other obligations. This left McLaren on the brink of insolvency.

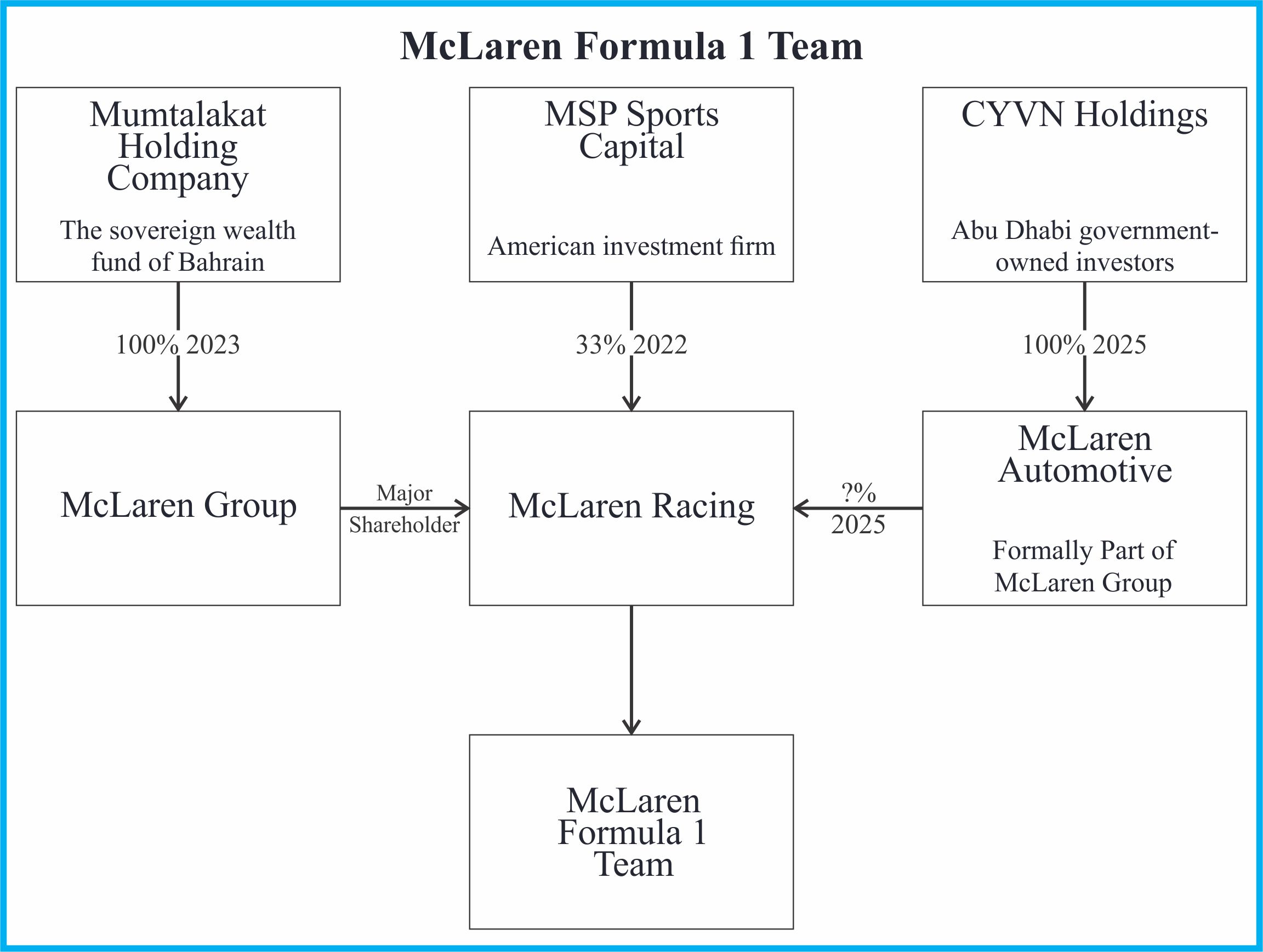

MSP Capital came to the rescue purchasing a 15% share in McLaren Racing or the McLaren Group, who then owned 100% of McLaren Racing. They raised this shareholding to a third in 2022. CYVN bought McLaren Automative which in its turn had a minority shareholding in McLaren Racing.

For most of 2025 the shareholding structure looked something like this-

McLaren at the start of 2025: Market Value – $2.65 Billion – £1.961 Billion

In early November it was announced that MSP Sports Capital had sold its shares to the other shareholders in an undisclosed transaction. Early reports stated that the share deal valued McLaren at $4.01 Billion (£3 Billion) with later reports saying the value was more than $5 Billion (£3.74 Billion).

Which ever is the true market valuation of McLaren, MSP certainly made at least 10 times its initial investment. This is believed to be the largest return for an institutional investor in the history of sport.

For McLaren the MSP investment saved them from insolvency and permitted them to become World Constructors’ Championship in 2024 and in all likelihood in 2025. What a turn around.

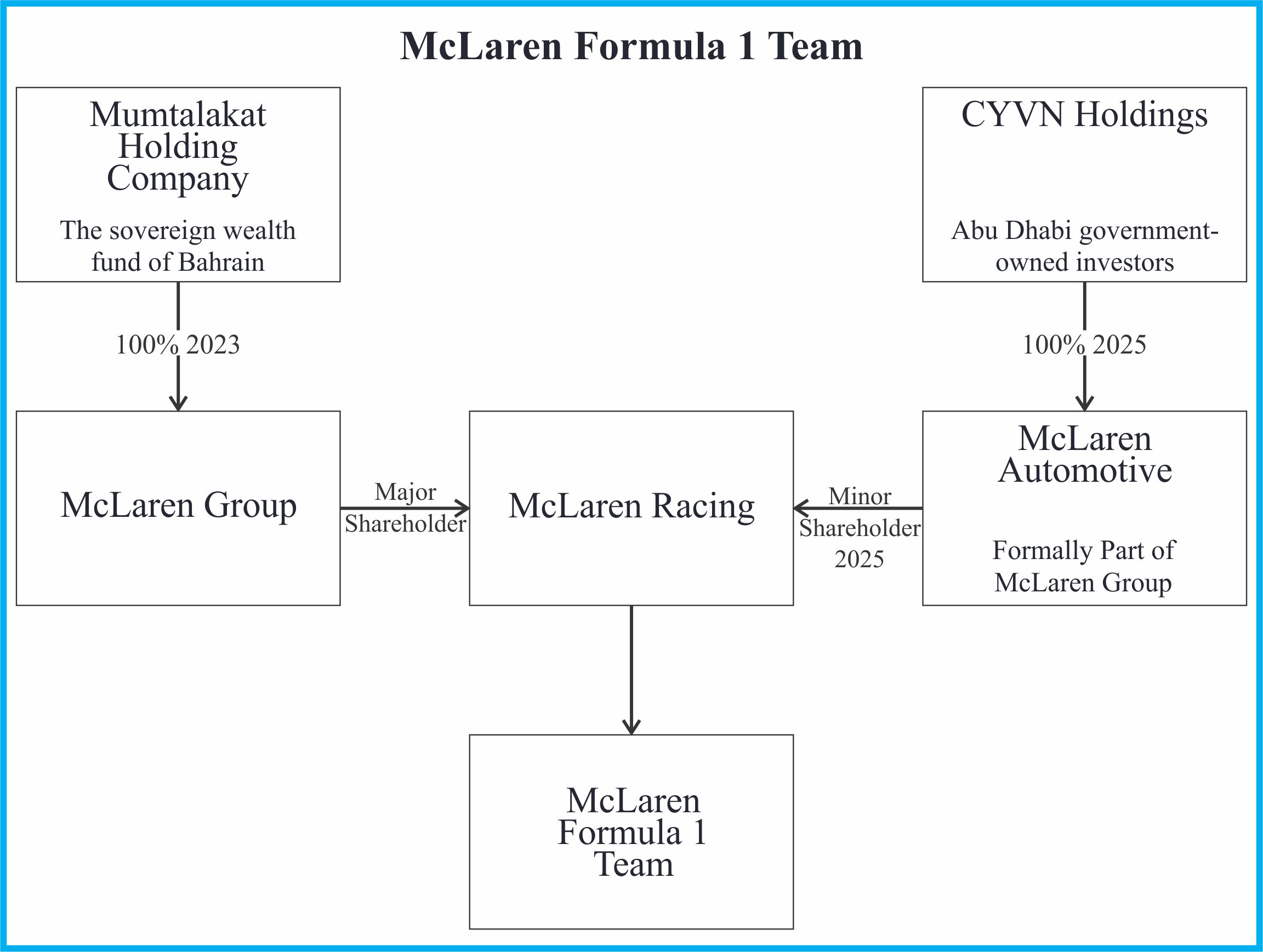

The current McLaren shareholding-